When the Business Insider published an article by Elena Holodny on 17th June, 2016 entitled The 5,000-year history of interest rates shows just how historically low US rates are right now the lights for all Governments’ Financial Regulators, The Financial Planning Standards Board and Global Fintech and Blockchain Hubs ( The Hubs) should have flashed red. Elena Holodny’s article included in Chart 1 a graph entitled “Still the lowest interest rates in 5,000 years” quoting as sources The Bank of England, Global Financial Data and Homer and Sylla’s “History of Interest Rates”. The historical low interest rates and record debt levels are a clear and present danger to variable rate home loan borrowers globally.

The question now arises will The Hubs seize the opportunity to help adjustable/variable rate mortgage home loan borrowers around the world? Another opportunity to help global home loan borrowers might not arise for many years. The Hubs can prevent unnecessary hardship for many millions of home loan borrowers in many countries.

In words, this is what the innovation opportunity is:

The process mapping steps should establish a client’s increased repayments limit at the time of the variable rate loan application. It would be expressed as a switch rate that triggers the lender’s offer to transfer to a fixed rate from a variable rate to stop repayment increases. The issue is whether The Hubs will see this as an automation opportunity whether by Blockchain smart contracts or otherwise. The role of the The Hub communities is to make sure it happens so that a lot of main street citizens can avoid unnecessary financial hardship.

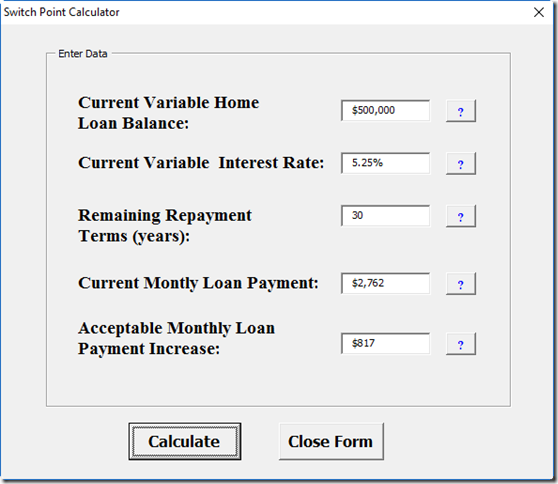

In a picture, this is what the input is :

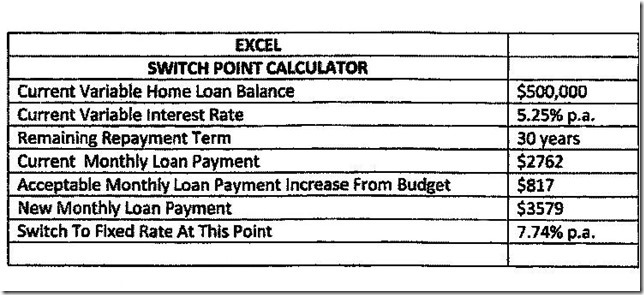

In a picture, this is what the output is :

WHY IS THIS IMPORTANT FOR THE AVERAGE VARIABLE RATE HOME LOAN BORROWERS THROUGHOUT THE WORLD?

In short, it is about the borrowers’ personal budgets from which their home loan repayments come. Many borrowers operate on tight budgets with very little capacity to absorb repayment increases and are therefore reluctant to switch to fixed rate borrowings which are usually at a higher rate. These borrowers are easily trapped in interest rate spirals that lead to rising repayments and financial distress.

THE IMF HAS ISSUED A HOUSING FINANCE AND REAL-ESTATE BOOM NOTE THAT THE HUBS CAN USE AS A REFERENCE POINT.

In 2015 Eugenio Cerutti, Jihad Dagher and Giovanni Dell’Ariccia published an IMF Staff Discussion Note entitled Housing Finance and Real-Estate Booms: A Cross-Country Perspective. Their reference for the report is SDN/15/12. This is a valuable resource for The Hubs because it looks at the issue of interest rates and housing finance globally. Of particular interest for innovators in The Hubs is the authors’ comment:

“Interest Type: Mortgage rates can be fixed through the life of a loan, or vary over time with changes linked to key interest rates in the economy. In our sample, the standard mortgage rate is variable in 30 countries, fixed in 12 countries; while in the remaining 14 countries both contracts are observed. Variable rates are more common in emerging economies.”

This is a global issue that The Hubs need to address urgently. Whether the International Blockchain Research Institute based in Canada sees it as a priority, will depend on the institute’s international members. In Jessie Willms article quoted in the Bitcoin Magazine Jessie stated: “Through a series of major research projects led by global experts, we will identify and explain key application opportunities, issues, strategies and approaches that enable companies and governments to capitalize on this emerging technology.†This issue is one of the most important for home loan borrowers globally.

GLOBAL INNOVATION, BLOCKCHAIN AND FINTECH HUBS MATTER

When Eugenio Cerutti, Jihad Dagher and Giovanni Dell’Ariccia published their note for the IMF in 2015, they would have known that disruptive innovation was well underway with financial technology and that variable/adjustable rate home loan borrowers urgently needed help. The Business Insider publication of the Bank of England, Global Financial Data, Homer and Sylla “A History of Interest Rates” research mentioned in the article The 5,000-year history of interest rates shows just how historically low US rates are right now made this clear. Thomson Reuters’ Where are the best FinTech centers? showed that this is an international trend to finding solutions to global issues. This is one of the most important that requires international co-operation. Those countries that refuse to co-operate will be left behind to the detriment of their populations.

SUMMARY

In the report THE BLOCKCHAIN CORRIDOR: Building an Innovation Economy in the 2nd Era of the Internet by Don Tapscott and Alex Tapscott there was a section on Education And Cultural Change in which is was said:

“Revolutionary new products and services often run into early skepticism, even mockery and hostility.Entrenched interests resist change, and established leaders are often the last to embrace the new, if they ever do.”

In some countries your involvement in innovation, research and development to promote reform and change would prompt some “leaders” to tell you to “mind your own business”. However, these countries will struggle to lead in the innovation race to the top for productivity through creativity. The Innovation Excellence LinkedIn Group has over 40,000 members. Innovation is the way to change the future and is the solution to many global critical issues. Don Tapscott and Alex Tapscott are right.

John Cosstick

Copyright